Contents of this section:

Costs of Iran’s nuclear programme

Impact of the nuclear programme and sanctions

Economic and safety arguments for renewable energy

Notes & References

4: Costs of Iran’s nuclear programme and the potential for renewable energy sources

4.1 Costs of Iran’s nuclear programme

Iran currently has one operating light-water reactor in Bushehr, with a total capacity of almost 1,000 MW. It reached commercial operation in 2013. The energy supplied by the reactor in 2014 accounted for a mere 1.5 percent of the total domestic production.254 Overall, the nuclear programme currently includes at least 15 facilities throughout the country.255,f

Due to a lack of detailed information, as a result of the Iranian government’s prohibition of open media coverage of the nuclear issue, the financial implications of this programme are largely unknown. Apparently not even the budgetary committee of the Iranian Parliament was provided with access to a cost report on the country’s nuclear reactor.256

The official budget of the Atomic Energy Organisation of Iran has been reported at IRR 2,992 billion in the financial year 2010/11. It continuously increased to IRR 8,382 billion in 2015/16, which is equivalent to an annual amount of around US$ 300 million, based on official exchange rates.257 While these budgets exceed those of many other ministries and state-affiliated agencies, they are hardly high enough to account for the full nuclear programme.

The programme’s direct financial costs are estimated to be around US$ 1billion to US$ 2 billion per year.258

In 2007, an analyst estimated the costs of the nuclear programme up until then to be over US$10 billion.259 Based on publicly available information in relation to contracts agreed with German and Russian suppliers, the costs of only the Bushehr nuclear reactor have been estimated at approximately US$ 11 billion.260,g

However, this figure increases tremendously when one also considers the effect of sanctions imposed on Iran as a consequence of its nuclear activities.

In 2013, analysts of the Carnegie Endowment for International Peace were the first to attempt to estimate the direct and indirect costs of the nuclear programme. In calculating the costs, the study considered the construction of reactors, operation and research, as well as the effect of sanctions placed on Iran and the resulting loss of foreign investments and oil production. This resulted in estimated costs of the controversial nuclear programme of more than US$ 100 billion. The extremely high construction costs are also caused by the concealed nature of most of the facilities, including dummy buildings, bunker facilities and anti-aircraft systems.261

In June 2015, one of the study’s authors gave an even higher estimate, referring to figures from former Iranian ministers, suggesting an amount close to US$ 500 billion for the Iranian nuclear programme.262

With the help of the ‘Nuclear Fuel Cycle Cost Calculator’ set up by the Bulletin of Atomic Scientists, estimates can be used to calculate the cost of one kilowatt hour of electricity based on the input, start-up, maintenance and financing costs of three different configurations of the so-called nuclear fuel cycle.263 Using ballpark figures for the different variables and assuming a purely civil use of the various nuclear installations in the country, a cost-benefit analysis of the Iranian nuclear programme clearly shows that the programme based on a single 1,000 MW reactor does not make any economic sense due to comparatively high production costs.264

4.2 Impact of the nuclear programme and sanctions on Iran’s economy

The nuclear programme, the related sanctions and the large military expenditure have undoubtedly taken a heavy social and economic toll on Iran over the years. While it is not possible to discern the impact of nuclear- and terrorism-related sanctions, and of Iran’s engagement in various Middle East conflicts, the tightening of sanctions related to the nuclear programme in 2011/12 showed considerable repercussions on the economy of the country.

Since 2012, Iran has suffered from recession due to sharply declining crude oil exports, its currency dramatically loosing value and resulting in spiraling inflation. As Reuters reported at the end of 2012, at that point even Iranian officials had to acknowledge the impact of sanctions on the country’s economy.265 For the first time in January 2013, Iran’s oil minister acknowledged that the fall in oil exports resulted in monthly losses of between US$ 4 billion and US$ 8 billion. According to some estimates, Iran suffered a loss of about US$ 26 billion in oil revenue in 2012, compared to a total of US$ 95 billion in 2011.266 According to US analysis, Iran was still exporting approximately 2.5 million barrels of oil a day to some 20 countries in 2012. This was reduced to around 1.1 million barrels and only six countries by early 2015.267

As a result of these developments, the already strained economy contracted by another 8.6 percent in two years from 2012.268 With falling oil prices aggravating the economic situation, President Rouhani was forced in early 2015 to significantly reduce budget projections. The initial budget presented in December 2014 for the fiscal year 2015/16 was still based on an average oil price of US$ 72 per barrel, down from about US$ 100 per barrel in the 2014 budget. However, in November 2015, oil has been trading at prices below US$ 50 and prices are not expected to rise in the near future. As a consequence, Rouhani also plans to reduce the country’s reliance on oil as a source of income, from an average of 45 percent of all revenues to about 31.5 percent.269

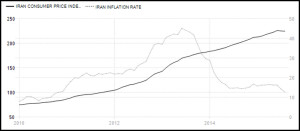

There are many factors responsible for the contracting Iranian economy over the last years, including a strong reliance on oil and gas, price controls, subsidies, and billions of dollars of non-performing loans held by the banking system.270 The large share of overdue loans in commercial banks’ portfolios, resulting in a ratio almost four times higher than the international standard, can be explained with the previous administration’s policy to support failing enterprises and the strong depreciation of the currency in 2013.271 The terrorism- and nuclear-related sanctions have undeniably contributed to this situation and visibly impacted the livelihoods of Iranians for many years. Consumers are faced with a weakening currency, soaring prices, deteriorating health care and high unemployment rates (see Figure 2).272

Many Iranians see the lifting of the sanctions as an essential first step to improve the economy.273 According to consumer surveys conducted in 2013,

- Over 85 percent of Iranians say that sanctions have hurt their personal livelihoods, including 50 percent who say that sanctions have hurt them personally a great deal.274

- Half of Iranians have not had enough money to pay for adequate food or shelter within the past year; 34 percent say that their standard of living is deteriorating.275

- Nonetheless, 68 percent of Iranians still believe that Iran should develop nuclear power; 56 percent say for non-military purposes, while 34 percent say for military purposes.276

- 46 percent of Iranians blame the US for the sanctions, while 13 percent believe that their own government is primarily responsible.277

In addition to limited political and religious freedom, the difficult economic situation has led to an ongoing ‘brain drain’, with highly educated young people leaving the country. From 2009 to 2013, more than 300,000 Iranians emigrated. 25 percent of Iranians with a post-graduate education live in developed OECD countries today. According to World Bank estimates, this development has cost the Iranian economy US$ 50 billion annually.278

However, overall the Iranian currency has stabilised and inflation has decreased considerably since Rouhani became president in 2013 and a first sanction relief was negotiated. Inflation slowed to 15.6 percent in June 2015, after reaching rates as high as 30.5 percent and 34.7 percent in the financial years 2012/13 and 2013/14 respectively (see Figure 2). In 2014, the Iranian economy also grew 3 percent, after two years of contraction.279

Figure 2: Development of Iran’s consumer prices and inflation rate

Source: Trade Economics, “Iran Consumer Price Index”, online: http://www.tradingeconomics.com/iran/consumer-price-index-cpi, accessed in October 2015.

If sanctions related to the nuclear programme are lifted, Iranian overseas assets with a value of approximately US$ 100 to 150 billion, mainly from oil sales proceeds, would become available. These revenues have been frozen as a consequence of the nuclear sanctions.

In addition, it is estimated that Iran will gain around US$ 20 billion a year in oil revenues once sanctions are lifted.280 Sanctions relief was already agreed in 2013, resulting in Iran gaining around US$ 7 billion in return for curbing uranium enrichment and giving UN inspectors better access to its facilities. World powers at the time also committed to facilitate Iran’s access to US$ 4.2 billion in restricted funds.281

It is obviously difficult to appraise how the Iranian economy would have developed without sanctions, considering the complex set of factors influencing it. The US Secretary of the Treasury Jacob Lew remarked in April 2015 that Iran’s economy “is today 15 to 20 percent smaller than it would have been had it remained on its pre-2012 growth trajectory. It will take years for Iran to build back up the level of economic activity it would be at now had sanctions never been put in place”.282

4.3 Economic and safety arguments for renewable energy sources in Iran

Iran is heavily dependent on oil and gas also for its own energy needs. Fossil fuels account for almost 98 percent of Iran’s total primary energy consumption. Of the 70 gigawatts (GW) of power generation capacity installed in the country, around 11 GW are low carbon sources, mostly hydropower (10 GW), while 1GW is nuclear and 0.1 GW is solar or wind.283 The current reliance on high-carbon energy sources means that Iran is among the top 10 emitters of CO2 worldwide.284

Despite the economic problems that the country is facing due to sanctions, subsidy reforms and mismanagement, the overall energy demand in Iran has not diminished.285 Throughout years of controversy around Iran’s nuclear programme, Iranian officials denied intents to use the enrichment of uranium to develop nuclear weapons. It was rather insisted that nuclear power was of crucial importance to the country to guarantee energy security and enable further economic growth.286

However, leaving aside the concerns around nuclear weapon proliferation, this does not seem a viable and sustainable option. Regardless of the location in the world, nuclear energy in general is connected to a range of barriers and risks, summarised by the Intergovernmental Panel on Climate Change (IPCC) as follows:

- operational risks;

- uranium mining risks;

- financial and regulatory risks;

- unresolved waste management issues.287

In the case of Iran, the issue of a suspected nuclear weapons programme triggered a range of international sanctions (see Chapter 3), with far-reaching economic consequences. As outlined in the previous chapter, the direct expenses, as well as the sanctions related to the nuclear programme, have already cost the country tens of billions of dollars. And this does not even include a host of future economic and environmental costs associated with pursuing a nuclear energy path.

Overall, the production of electricity under the current Iranian set-up is not competitive in comparison with other energy sources (see section 4.1). Countering the argument of the enormous costs incurred for putting the 1,000 MW Bushehr plant into operation and the resulting high production costs, the Iranian Atomic Energy Organisation has pointed out the project would be economically viable with two to four more power plants added in Bushehr.288 However, it is improbable that such an investment would lead to competitive production prices, especially when considering the other risks connected to nuclear energy.

As with any non-renewable energy, nuclear energy production relies on a depleting source. Uranium mining is not only connected to massive environmental degradation; resource depletion is also expected to lead to spiraling nuclear fuel costs in the coming decades.289

In addition to the setting-up of the necessary up- and downstream facilities, the radioactive waste produced by nuclear power is immense. The costs of the development of a nuclear waste disposal programme are huge, if not incalculable. The required timelines are beyond human imagination and so far no solutions consistent with the safety and security requirements have been found anywhere in the world, despite decades of research.290

Disasters can never be excluded, whether caused by an attack, natural forces or human error. An attack on a nuclear power plant, whether intentional or accidental, would be disastrous and is of concern in a politically unstable region like the Middle East.

The impact of natural forces like earthquakes is also not controllable. The fact that Iran is one of the seismically most active countries in the world cannot be ignored.291 The example of the catastrophic consequences of the Tsunami and earthquake on the Japanese nuclear power plant Fukushima in 2011 illustrates the consequences. Leaving aside any of the other economic impacts caused by the damaged reactors in Fukushima, the first four years of decontamination efforts have already cost an estimated US$ 13 billion. And this does not include the costs of actual decommissioning of the reactor and disposal of the nuclear waste.292 In a 2014 study, Japanese scientists estimated the overall costs of the Fukushima accident to increase to at least ¥11.08 trillion (US$ 97 billion).293

It is interesting to compare the situation in Iran with a country like Germany, which is seen to be at the forefront of developing renewable energy sources. Triggered by the Fukushima disaster, Germany took eight reactors off the national grid within a short period of time and legally required the phase-out of all nuclear power plants by 2022.294 The move to renewable energy resources made Germany the world’s leader in installed solar photovoltaic (PV) capacity and PV coverage of peak demand.295 The country boasts the largest installed wind power capacity.296

Comparing the geographic location in Germany and Iran, the latter undoubtedly holds greater potential for renewable energy. Sunshine hours in Iran are far more than in Germany; most regions in Iran enjoy around 3,000 hours of sunshine per year,297 compared to only around 1,600 hours in Germany.298 The Lut Desert in eastern Iran has the hottest land surface temperature on record, while the mountainous west and northeast parts of the country hold unique wind corridors.299 In addition, geothermal and biomass energy production carry considerable potential for energy generation in Iran.300

Iran’s government has recognised this potential and increased investment in renewable energies in recent years, with the aim of alleviating pollution in urban areas but also reducing the country’s heavy dependency on oil and gas.301 In 2012, Iran had the highest production of renewable energies in the region, with 12,553 GWh, accounting for more than half of the total renewable generation in the Middle East.302 This was largely sourced from hydropower, accounting for approximately 10,000 GWh at the time.303 The country aims to set up a solar energy production programme with a capacity of 10,000MW by 2020. By 2018, 5,000MW of electricity using renewable energy sources are planned to be added, on top of the currently generated 10,000MW of hydropower.304 Iranian officials estimate the country’s wind potential alone at more than 30,000MW, and the solar power potential at 10,000MW.305

Calculations comparing the economics of nuclear versus renewable energy sources in Iran come to the conclusion that even when assuming high-end estimates on costs of capital, the costs of renewable electricity in Iran would be competitive. This also offers opportunities for other countries to develop strategic partnerships, technology-sharing initiatives and joint ventures supporting such a move.306

Renewable energy technologies, including wind, solar and biomass technologies are not included in the EU sanctions against Iran. Such sales are banned for US companies, though, unless a specific license is granted.307 However, despite being a non-sanctioned business, renewable energy companies are faced with collateral issues like canceled bank transactions and problems in importing spare parts.308 Once sanctions are relieved, renewable energies could get a major boost. It is also noteworthy that, contrary to nuclear power, renewable energy projects have strong potential to attract foreign investors.309

Notes & References

f. Including, among others, nuclear research centres, uranium mines, mills and conversion facilities.

g. Measured in 2012 dollars; obtained by converting the US$4.3 billion of 1975 and US$ 1.24 billion of 1995 to 2012 dollar based on the inflation and exchange rates reported by the Central Bank of Iran.

254. International Atomic Energy Agency (2015), Annual Report 2014, p.147;

Rosen, A. (2015, July 1), “Iran’s nuclear program may have cost the country $500 billion or more”, Business Insider UK, online: http://uk.businessinsider.com/irans-nuclear-program-has-been-an-astronomical-waste-for-the-country-2015-6?r=US&IR=T, accessed in September 2015.

255. Rosen, A. (2015, July 1), “Iran’s nuclear program may have cost the country $500 billion or more”, Business Insider UK, online: http://uk.businessinsider.com/irans-nuclear-program-has-been-an-astronomical-waste-for-the-country-2015-6?r=US&IR=T, accessed in September 2015.

256. Vaez, A. and K. Sadjadpour (2013), Iran’s Nuclear Odyssey: Costs and Risks, Washington DC, United States: Carnegie Endowment for International Peace, p.2, 12.

257. Annual budgets of the Islamic Republic of Iran, available at Princeton University, “Iran Data Portal”, online: http://www.princeton.edu/irandataportal/socioecon/annual-budgets/, accessed in October 2015;

Parliament of the Islamic Republic of Iran, in: Vaez, A. and K. Sadjadpour (2013), Iran’s Nuclear Odyssey: Costs and Risks, Washington DC, United States: Carnegie Endowment for International Peace, p.12.

258. Clawson, P. (2015, July 10), “How Iran’s economic gain from a nuclear deal might affect its foreign policy”, Policy Watch 2452, Washington, United States: The Washington Institute.

259. Taheri, A. (2007, November 15), “Who are Iran’s Revolutionary Guards?”, The Wall Street Journal, online: http://www.wsj.com/articles/SB119509278241693687, accessed in October 2015.

260. Vaez, A. and K. Sadjadpour (2013), Iran’s Nuclear Odyssey: Costs and Risks, Washington DC, United States: Carnegie Endowment for International Peace, p.12.

261. Vaez, A. and K. Sadjadpour (2013), Iran’s Nuclear Odyssey: Costs and Risks, Washington DC, United States: Carnegie Endowment for International Peace, p.2,12.

262. Hibbs, M., Sadjadpour, K., Perkovich, G. and T. Carver (2015, June 30), “Media call: Iran nuclear negotiations”, Carnegie Endowment for International Peace, online: http://carnegieendowment.org/2015/06/30/media-call-iran-nuclear-negotiations/ib9c, accessed in September 2015.

263. Rosner, R., Klavans, J. and S. Olofin (2015), “Nuclear fuel cycle cost calculator”, Bulletin of the Atomic Scientists, online: http://thebulletin.org/nuclear-fuel-cycle-cost-calculator¸accessed in September 2015.

264. Rosen, A. (2015, July 1), “Iran’s nuclear program may have cost the country $500 billion or more”, Business Insider UK, online: http://uk.businessinsider.com/irans-nuclear-program-has-been-an-astronomical-waste-for-the-country-2015-6?r=US&IR=T, accessed in September 2015.

265. Reuters (2012, December 10), “Sanctions push Iran into recession: IIF”, online: http://www.reuters.com/article/2012/12/10/us-iran-sanctions-economy-idUSBRE8B90OF20121210, accessed in September 2015.

266. BBC News (2015, March 30), “Iran nuclear crisis: What are the sanctions?”, online: http://www.bbc.com/news/world-middle-east-15983302, accessed in August 2015.

267. US Department of the Treasury (2015, January 21), “Testimony of Under Secretary Cohen before the Senate Foreign Relations Committee on Iran”, online: http://www.treasury.gov/press-center/press-releases/Pages/jl9746.aspx, accessed in October 2015.

268. Gilmore, S. (2014, November 10), “Iranian capital markets to be ‘Turkey on steroids’ if November nuclear deal is reached”, Emerging Markets, online: http://www.emergingmarkets.org/Article/3389512/Iranian-capital-markets-to-be-Turkey-on-steroids-if-November-nuclear-deal-is-reached.html, accessed in September 2015.

269. Reed, M.M. (2015, January 30), “How Iran Is coping with sagging oil prices”, Newsweek, online: http://www.newsweek.com/how-iran-coping-sagging-oil-prices-303298¸ accessed in October 2015.

270. Central Intelligence Agency, “The World Factbook: Middle East: Iran: Economy overview”, online: https://www.cia.gov/library/publications/the-world-factbook/geos/ir.html, accessed in October 2015;

Al-Monitor (2015, January 13), “Action needed to reform Iranian banks”, online: http://www.al-monitor.com/pulse/originals/2015/01/iran-banks-hassan-rouhani.html#, accessed in October 2015.

271. Wilson, N. (2014, May 8), “Iran push to recover bad debt highlights black hole but signals new era”, International Business Times, online: http://www.ibtimes.co.uk/iran-push-recover-bad-debt-highlights-black-hole-signals-new-era-1447767, accessed in October 2015;

Al-Monitor (2015, January 13), “Action needed to reform Iranian banks”, online: http://www.al-monitor.com/pulse/originals/2015/01/iran-banks-hassan-rouhani.html#, accessed in October 2015.

272. Luers, W., Bieri, I. and P. Lewis (2012), Weighing Benefits and Costs of International Sanctions Against Iran, New York, United States: The Iran Project, p.51;

Almashat, S. and M. Shirazi (2015, March 28), “Iran sanctions debate ignores civilian impact”, Al Jazeera, online: http://www.aljazeera.com/indepth/opinion/2015/03/iran-sanctions-debate-ignores-civilian-impact-150328071100321.html, accessed in October 2015;

Katzman (2015, August 4), Iran sanctions, Washington, United States: Congressional Research Service, p.49;

Shahabia, S., Fazlalizadeh, H., Stedman, J., Chuang, L., Shariftabrizi, A. and R. Ram (2015, August 22), “The impact of international economic sanctions on Iranian cancer healthcare”, Health Policy, in press, doi:10.1016/j.healthpol.2015.08.012;

The World Bank, “Countries – Iran”, online: http://www.worldbank.org/en/country/iran/overview, accessed in October 2015.

273. BBC News (2015, March 30), “Iran nuclear crisis: What are the sanctions?”, online: http://www.bbc.com/news/world-middle-east-15983302, accessed in August 2015.

274. Gallup (2013, November), “Most Iranians say sanctions hurting their livelihoods”, online: http://www.gallup.com/poll/165743/iranians-say-sanctions-hurting-livelihoods.aspx?utm_source=alert&utm_medium=email&utm_campaign=syndication&utm_content=morelink&utm_term=World, accessed in August 2015.

275. Gallup (2013, June), “Half of Iranians lack adequate money for food, shelter”, online: http://www.gallup.com/poll/163295/half-iranians-lack-adequate-money-food-shelter.aspx, accessed in August 2015.

276. Gallup (2013, October), “Iranians mixed on nuclear capabilities”, online: http://www.gallup.com/poll/165413/iranians-mixed-nuclear-capabilities.aspx, accessed in August 2015.

277. Gallup (2013, November), “Most Iranians say sanctions hurting their livelihoods”, online: http://www.gallup.com/poll/165743/iranians-say-sanctions-hurting-livelihoods.aspx?utm_source=alert&utm_medium=email&utm_campaign=syndication&utm_content=morelink&utm_term=World, accessed in August 2015.

278. Khajehpour, B. (2014), “Can Rouhani reverse Iran’s brain drain?”, Al Monitor, online: http://www.al-monitor.com/pulse/originals/2014/01/iran-economy-diaspora-reconciliation-sustainable-progress.html#, accessed in August 2015;

Motevalli, G. (2014, May 8), “Iran’s brain drain is the West’s gain”, Bloomberg Business, online: http://www.bloomberg.com/bw/articles/2014-05-08/irans-best-engineering-science-grads-take-skills-abroad, accessed in August 2015;

Bremmer, I. (2015, July 18), “The 5 biggest ways that Iran’s economy will benefit from the nuclear deal”, Business Insider, online: http://www.businessinsider.com/the-5-biggest-ways-that-irans-economy-will-benefit-from-the-nuclear-deal-2015-7?IR=T#ixzz3k64uLeBC, accessed in October 2015.

279. Central Bank of the Islamic Republic of Iran (2014, May), Methodology of Consumer Price Index for All Urban Consumers, p.6;

Islamic Republic News Agency (2015, June 27), “Iran’s Central Bank puts inflation rate at 15.6%”, online: http://www.irna.ir/en/News/81661148/¸accessed in October 2015;

Nasseri, L. and G. Motevalli (2015, July 14), “Iran targets 25-year inflation low by 2017 as sanctions removed”, BloombergBusiness, online: http://www.bloomberg.com/news/articles/2015-07-14/iran-targets-25-year-inflation-low-by-2017-as-sanctions-removed¸ accessed in October 2015.

280. Rothkopf, D. (2015, April 16), “Iran’s $300 billion shakedown”, Foreign Policy, https://foreignpolicy.com/2015/04/16/irans-300-billion-shakedown-sanctions-nuclear-deal/, accessed in October 2015;

Goldberg, J. (2015, May 21), “‘Look … It’s my name on this’: Obama defends the Iran nuclear deal”, The Atlantic, online: http://www.theatlantic.com/international/archive/2015/05/obama-interview-iran-isis-israel/393782/, accessed in October 2015;

Reuters (2015, July 14), “Iran to have access to over $100 billion when deal implemented: U.S. officials”, online: http://www.reuters.com/article/2015/07/14/us-iran-nuclear-usa-details-idUSKCN0PO14D20150714, accessed in October 2015.

281. BBC News (2015, March 30), “Iran nuclear crisis: What are the sanctions?”, online: http://www.bbc.com/news/world-middle-east-15983302, accessed in August 2015.

282. Lew, J.J. (2015, April 29), “Remarks of Treasury Secretary Jacob J. Lew to The Washington Institute”, Conference marking the Washington Institute’s 30th anniversary, online: http://www.washingtoninstitute.org/policy-analysis/view/remarks-of-treasury-secretary-jacob-j.-lew¸ accessed in October 2015.

283. Rahnama, M. (2015, May 15), “Renewable Iran: Creating the energy network of the future”, Bourse & Bazaar, online: http://www.bourseandbazaar.com/articles/2015/5/25/renewable-iran-create-the-energy-network-of-the-future, accessed in October 2015.

284. Environmental Performance Index (2014, June 14), “Who are the largest emitters of carbon pollution?”, online: http://epi.yale.edu/the-metric/who-are-largest-emitters-carbon-pollution, accessed in October 2015..

285. Khajepour, B. (2013, July 26), “Iran’s renewable energy sector poised for growth”, Al-Monitor, online: http://www.al-monitor.com/pulse/originals/2013/07/renewable-energy-iran-development.html, accessed in October 2015.

286. See for example: Sahimi, M., Mojtahed-Zadeh, P. and K.L. Afrasiabi (2003, October 14), “Energy : Iran needs nuclear power”, The New York Times, online: http://www.nytimes.com/2003/10/14/opinion/14iht-edsahimi_ed3_.html, accessed in October 2015;

PressTV (2013, September 18), “Rouhani stresses peaceful nature of Iran’s nuclear energy program”, online: http://presstv.com/detail/2013/09/18/324754/iran-will-never-develop-nukes-rouhani/, accessed in October 2015;

Mousavian, S.H. (2014, February), “How much nuclear power does Iran need?”, Al-Monitor, online: http://www.al-monitor.com/pulse/originals/2014/02/iran-nuclear-energy-domestic-need.html#¸ accessed in October 2015.

287. IPCC, In: Edenhofer, O., R. Pichs-Madruga, Y. Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel and J.C. Minx (eds.) (2014), Climate Change 2014, Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, Cambridge, United Kingdom: Cambridge University Press, p.22.

288. Mousavian, S.H. (2014, February), “How much nuclear power does Iran need?”, Al-Monitor, online: http://www.al-monitor.com/pulse/originals/2014/02/iran-nuclear-energy-domestic-need.html#¸ accessed in October 2015.

289. Ahmed, N. (2013, July 2), “The coming nuclear energy crunch”, The Guardian, online: http://www.theguardian.com/environment/earth-insight/2013/jul/02/nuclear-energy-crunch-uranium-peak-blackouts, accessed in October 2015;

Dittmar, M. (2013, September 1), “The end of cheap uranium”, Science of the Total Environment, Vol.461-462: 792-798.

290. See for example: Union of Concerned Scientists (n.d.), “The elusive permanent repository”, online: http://www.ucsusa.org/nuclear-power/nuclear-waste/permanent-waste-repository#.VhQfcPmqqko, accessed in October 2015;

Budde, A. (2011, May 3), “Ein Fels für die radioaktive Ewigkeit“, Die Zeit, online: http://www.zeit.de/wissen/umwelt/2011-05/atommuell-endlager-skandinavien¸ accessed in October 2015;

Bell, R. (2014, November 1), “Nuclear waste must be out of sight, but not out of mind”, The Guardian, online: http://www.theguardian.com/environment/2014/nov/01/nuclear-waste-underground-storage, accessed in October 2015;

Eidemüller, D. (2015, April 27), “6 Fakten über unseren Atommüll und dessen Entsorgung“, Spektrum , online: http://www.spektrum.de/wissen/6-fakten-ueber-unseren-atommuell-und-dessen-entsorgung/1342930, accessed in October 2015.

291. World Earthquakes, “Global seismic activity for earthquakes with Mw 6.5+”, online: http://www.world-earthquakes.com/index.php?option=sta, accessed in October 2015.

292. Makinen. J. (2015, March 11), “After 4 years, Fukushima nuclear cleanup remains daunting, vast”, Los Angeles Times, online: http://www.latimes.com/world/asia/la-fg-fukushima-nuclear-cleanup-20150311-story.html, accessed in October 2015.

293. The Japan Times (2014, August 27), “Fukushima nuclear crisis estimated to cost ¥11 trillion: study”, online: http://www.japantimes.co.jp/news/2014/08/27/national/fukushima-nuclear-crisis-estimated-to-cost-%C2%A511-trillion-study/#.VhPVL_mqpBc, accessed in October 2015.

294. Wetzel, D. (2015, March 11), “Deutschland beim Atomausstieg allein auf weiter Flur”, Die Zeit, online: http://www.welt.de/wirtschaft/energie/article138288809/Deutschland-beim-Atomausstieg-allein-auf-weiter-Flur.html, accessed in October 2015.

295. Renewables International (2015, June 29), “Per capita ranking of countries for wind and solar”, http://www.renewablesinternational.net/per-capita-ranking-of-countries-for-wind-and-solar/150/537/88470/, accessed in October 2015.

296. The European Wind Energy Association (2015, February), Wind in Power – 2014 European Statistics, p.3.

297. Rahimzadeh, F., Pedrama, M. and M.C. Kruk (2014), “An examination of the trends in sunshine hours over Iran”, Meteorological Applications, Vol.21(2): 309-315.

298. Deutscher Wetterdienst (2013), Sonnenscheindauer: langjährige Mittelwerte 1981 – 2010.

299. Faucon, B. (2012, September 17), “In Iran, the wind blows free. Of sanctions, that Is.”, Wall Street Journal, online: http://www.wsj.com/articles/SB10000872396390443659204577574972899961532, accessed in October 2015.

300. Reza Asadi Asad Abad, M., Moharrampour, M., Abdollahian, H., Shir Ali, M. and F. Mohagheghzadeh (2012, May), “Developing renewable energies in Iran”, International Journal of Energy, Information and Communications, Vol.3(2): p.17-28.

301. Alic, J. (2012, September 10), “Invest in Iran’s renewable energy? Not so crazy.”, Christian Science Monitor, online: http://www.csmonitor.com/Environment/Energy-Voices/2012/0910/Invest-in-Iran-s-renewable-energy-Not-so-crazy, accessed in October 2015;

Faucon, B. (2012, September 17), “In Iran, the wind blows free. Of sanctions, That Is.”, Wall Street Journal, online: http://www.wsj.com/articles/SB10000872396390443659204577574972899961532, accessed in October 2015.

302. US Energy Information Administration, “International energy statistics”, online: http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm?tid=6&pid=29&aid=12, accessed in October 2015.

303. Power-Technology (2013, April 2), “Iran to build second hydro plant in Tajikistan”, online: http://www.power-technology.com/news/newsiran-mulls-240mw-ayni-hydroelectric-power-plant-in-tajikistan, accessed in October 2015.

304. Ayre, J. (2014, May 14), “Iran Going Big With Renewables! 5,000 MW Of New Solar & Wind Capacity By 2018?”, Clean Technica, online: http://cleantechnica.com/2014/05/14/iran-going-big-renewables-5-gw-new-solar-wind-capacity-2018/, accessed in October 2015;

PressTV (2015, August 10), “Iran, Spain sign agreement on renewable energy”, online: http://www.presstv.ir/Detail/2015/08/10/424124/Iran-Spain-Solar-energy-, accessed in October 2015.

305. Tehran Times (2015, June 16), “Iran has potential to generate 40,000MW of solar, wind power: official”, online: http://www.tehrantimes.com/index_View.asp?code=247428, accessed in October 2015;

Brautlecht, N. and S. Nicola (2015, July 30), “Iran’s thirst for energy draws in wind developers”, BloombergBusiness, online: http://www.bloomberg.com/news/articles/2015-07-29/nuclear-deal-opens-market-as-big-as-france-for-iran-wind¸ accessed in October 2015.

306. Buonomo, T. (2015, May 5), U.S.-Iran Energy Diplomacy: An Analysis of the Potential for Renewable Energy Partnerships to Serve as a Vehicle for Détente with Iran, Imes Capstone Paper Series of the Institute for Middle East Studies, Washington DC, United States: The George Washington University, p.6,33.

307. Faucon, B. (2012, September 17), “In Iran, the wind blows free. Of sanctions, that is.”, Wall Street Journal, online: http://www.wsj.com/articles/SB10000872396390443659204577574972899961532, accessed in October 2015.

308. Faucon, B. (2012, September 17), “In Iran, the wind blows free. Of sanctions, that is.”, Wall Street Journal, online: http://www.wsj.com/articles/SB10000872396390443659204577574972899961532, accessed in October 2015.

309. Financial Tribune Iran (2015, February 14), “Foreign interest in renewable energy projects”, online: http://financialtribune.com/articles/energy/11114/foreign-interest-renewable-energy-projects¸ accessed in October 2015;

Mittal, S. (2015, August 27), “German investors to back wind energy project in Iran”, CleanTechnica, online: http://cleantechnica.com/2015/08/27/german-investors-back-wind-energy-project-iran/¸accessed in October 2015.

English

English  فارسی

فارسی  العربية

العربية